Connections

M&E Journal: Local Relationships: The Bedrock of Global Success

Story Highlights

By Teresa Phillips, Senior VP, V2Solutions –

In January, many of us were surprised by Netflix’s announcement at CES that it had launched its streaming television service in 190 local markets across the world. It marked a major step forward in the ever escalating battle for supremacy in capturing a bigger share of the diverse local markets for video content and has been one of the most widely covered new stories of the year.

But lost amidst the company’s bold declaration was an unacknowledged part of its message. Though the service is available in these markets, very little content is actually available in many of those 190 countries. Moreover, across those 190 countries, Netflix content is translated into just 21 languages, meaning that most of what’s available now is English-language content with little appeal to local consumers.

Of even greater significance, however: until Netflix made its announcement, few people in the industry were even aware that there are 190 different viable local markets. The top five global over-the-top (OTT) providers—Apple, Google, Amazon, Microsoft, and Sony—distribute to just 107 of those countries, with Apple and Google leading the way and the others trailing significantly. And very little of what any of them distribute to those markets is content that has been truly localized, holding, at best, limited appeal to those consumers.

Content providers and retailers are behaving as though this is a simple land grab, focused mostly on getting their titles into a given market with minimal localization.

A clear example of the failure to cater to local consumers can be seen in the growing number of incorrectly rated titles across various countries. Tens of thousands of titles are given a rating that does not comply with local country guidelines or is simply released on storefronts without a rating at all. Absent meaningful, local ratings, retailers and content providers fail to inform parents accurately about the nature of programs, hampering them from making viewing decisions suitable for their families. Figure 1 illustrates one way in which OTT distributors are crippling themselves even as they attempt to create global traction.

Of course, despite this data, there are still some in the industry that believe it simply doesn’t matter. The truth is, however, that it matters a great deal, and we’re seeing the evidence of that across the globe. To much public fanfare last year, Google Play Singapore was forced to remove several of its titles from stock by the local censorship board one week after launching in-country.

The situation was exacerbated by local video retailers who were caught up in the same restriction and were kept from selling those same banned titles in their stores. When content providers and retailers don’t abide by local policies, censorship boards are swift to take action—often unraveling corporate strategies created in boardrooms on another continent.

The situation was exacerbated by local video retailers who were caught up in the same restriction and were kept from selling those same banned titles in their stores. When content providers and retailers don’t abide by local policies, censorship boards are swift to take action—often unraveling corporate strategies created in boardrooms on another continent.

Sony Pictures Networks India EVP and head of digital business, Uday Sodhi, has noted how few of the millions of Indian OTT consumers are actually willing to pay for the content they view. “One report states that there are 25 million OTT subscribers in the market today, of which pay subscribers would be less than 5 percent,” he explains, further noting that 90 percent of revenue at the box office in India is from titles made in India. The conclusion is clear—when the content is geared towards the culture of that region, consumers there will pay for it.

This same axiom holds true in Japan and South Korea as well, where more than 60 percent of annual box-office receipts come from homegrown films. Japan alone posted box-office revenues in 2015 of over $1.8 billion. Both of these regions are extremely tech-savvy, with consumers eager to embrace OTT. Yet inroads there have been slow for the big five U.S. OTT distributors, due in large part to their lack of locally-sourced or meaningful localized content.

In all three of these countries—all of them major movie markets—locally-produced content makes up the clear majority of what drives in-cinema ticket sales. Yet when those countries are analyzed in terms of their OTT stores, only a small percentage of the titles there are locally sourced. The industry simply is not giving consumers in these and many other global markets what they want to watch and pay for.

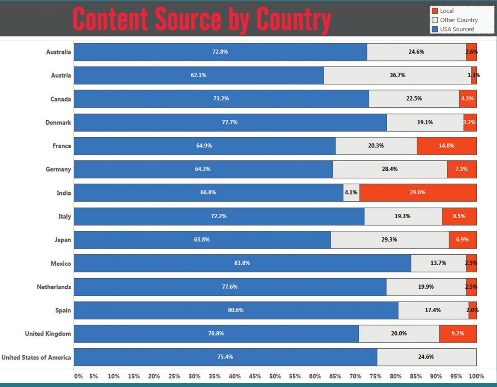

As shown in Figure 2, outside of India and France, locally-sourced OTT titles made up less than 10 percent of catalogs in local markets in 2015.

Netflix commits to local content creation

If one thing was made clear from Netflix’s landmark January announcement, it was that it at least has an awareness of and appreciation for the value of reaching these disparate markets simultaneously. Opening the pipeline is its first step; global licensing of content and creating meaningful, original content will be the next steps.

Much as it has already done in the U.S. with Netflix-exclusive content such as House of Cards and Orange is the New Black, Netflix appears committed to bringing local content to each market by producing it themselves. During his January CES keynote, CEO Reed Hastings declared that Netflix will spend $5 billion in 2016 in creating original content, second only to ESPN. To provide perspective, HBO is expected to spend $2 billion on content in 2016, up 20 percent over previous years, in response to Netflix’s bold ambitions.

With 78 percent of global box office receipts in 2015 coming from international ticket sales, Hollywood studios understand that local relationships are imperative for success. Even a cursory survey of the industry shows that studios have realized this—consider Warner Bros and China Media Capital, Walt Disney and Shanghai Media Group, Fox International Productions in Russia, and Sony Pictures Entertainment in India. Major studios are partnering with local filmmakers and production companies to create content that will better serve local audiences worldwide.

For most global OTT distributors, creating their own content isn’t a viable option, of course, but there are other strategies to employ that can enable them to take advantage of the enormous opportunity before them—serving local markets in a locally attractive way.

Our own experience at V2Solutions has shown us that local relationships are the bedrock of global success in the industry. Three basic foundations have proven tremendously effective in building local relationships, and thus, viewership.

First, distributors must provide an accurate local rating, building a relationship with the local state and authorities. Second, create audio dubs and localized edits by building relationships with local talent and post- production companies. And third, localize the full metadata of the title including the title, synopsis, and the artwork, to make the listing more appealing to the local audience.

The most difficult of these three foundations is dealing with local ratings. The process for obtaining an accurate local rating from each country is difficult to discern and complicated to manage. To help ease this process, retailers and content providers should work together on industry standards to ensure that local ratings are consistently assigned and uniform across storefronts.

In building local relationships at multiple levels, content providers and retailers embrace a global mindset and increase cultural sensitivity, demonstrating respect for people from different backgrounds.

Naturally, some of these strategic plans require investment. But the payoff is clearly evident. According to MarketsandMarkets, the global OTT market is set to grow to $54 billion by 2019, up from $25 billion at the beginning of 2015. That’s tremendous growth potential, but it will only be available to distributors who understand and respond to the needs of local consumers. Localizing isn’t about focusing solely on blockbuster American releases, nor is it simply a matter of translation and subtitles. It’s about personalizing the customer experience from region to region, with respect to local consumers’ culture, tastes, and customs.

OTT providers must make their catalogs truly engaging from a local point of view. Only then will they succeed in creating a connection with consumers that translates into the kind of relationship that fosters brand loyalty and ongoing success.

Click here to translate this article

Click here to download the complete .PDF version of this article

Click here to download the entire Spring 2016 M&E Journal