M+E Connections

News Corp. Execs: Company Boosted by Foxtel Purchase, Digital Growth in Q4

Story Highlights

The stronger results that News Corp. reported for the fourth quarter (ended June 30) were driven by contributions from Australian pay TV company Foxtel, which it bought earlier this year, and continued growth in its digital business, according to company executives.

“We are seeing strong digital paid subscriber growth across many of our key properties, where digital subscribers now exceed print,” CFO Susan Panuccio said on an earnings call Aug. 9. Total digital revenue for the quarter grew 12%, the “highest growth in recent periods due to the strength of … downloadable audio books and represented 20% of consumer revenues, in line with the prior year,” she said.

In News Corp.’s Digital Real Estate Services segment, revenue increased 19% to $299 million, she said. Total News Corp. revenue jumped 29% to $2.69 billion, while its loss narrowed to $372 million (64 cents a share) from $430 million (74 cents a share).

Among the major themes from this past year and Q4 were the steps that News Corp. took “to stabilize” its News and Information Services segment, where “tangible improvement” was accomplished “through a combination of cost initiatives and digital investments,” Panuccio said.

The company also “focused on strengthening” the Digital Real Estate Services platform “by expanding into relevant adjacencies, investing in new businesses and products and growing our core audiences,” she told analysts, noting that segment was the company’s “biggest EBITDA contributor and annual revenue” in it now “exceed well over $1 billion and have more than tripled.”

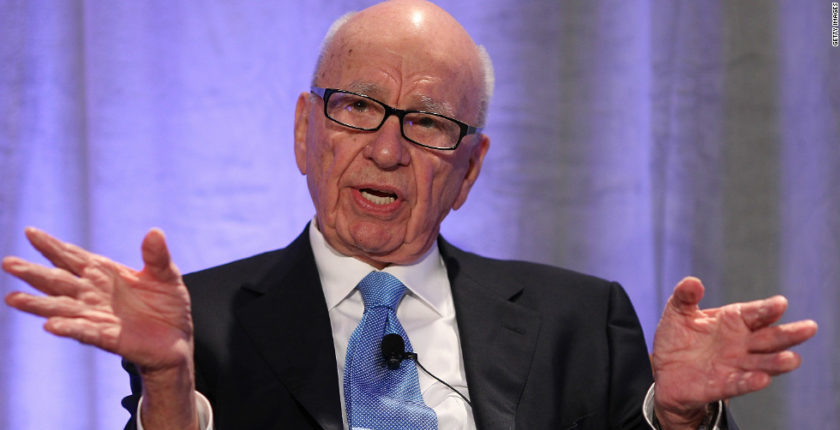

The company’s goal for its combined Foxtel and Fox Sports Australia business continues to be an initial public offering (IPO), she and News Corp. CEO Robert Thomson said on the call without providing any specifics on timing.

“Improving subscription volumes will be key to our long-term value creation” for that business, Panuccio also said, adding over-the-top (OTT) “will be a key growth initiative and our goal will be to maintain the broadcast subscriber base and manage churn effectively.”

Total revenue in News Corp.’s Subscription Video Services business, which includes Foxtel and Fox Sports Australia, soared to $610 million from $140 million.

For that segment, the company expects “reinvestment this year” that will focus on launching new OTT products, 4K, the next generation of the Foxtel iQ digital set-top box and “managing our valuable broadcast base,” she said.

When the company launched the “new” News Corp. five years ago, “we promised to be relentlessly digital and global and that we would remain faithful to the principles and the values inherited from the founding company,” Thomson told analysts. “While we ardently believe there is much toil head, we are confident that closer integration between and among our companies is helping us realize that potential,” he said.

Meanwhile, “constructive conversations are underway with Google, YouTube and Facebook to recognize prominence, contract piracy and share the permission data that was generated by our journalism and our creative work,” he went on to say. He added: “We sense that these companies are conscious that the editorial ecosystem is changing, and that IP is a priority, while piracy and pedantry are anathema to the growth of a healthy and harmonious community.”

While reporting News Corp.’s Q2 results in a Feb. 8 earnings call, Thomson pointed out: “Clearly, there are profound changes taking place in the creation and the distribution of digital content.

The big tech disruptors are in the midst of a particularly disruptive period commercially, socially and politically.” While “we appreciate that Google has ended the prejudicial” First Click Free policy and that Facebook is “prioritizing prominence,” he said those were just “modest steps towards changing a digital environment that is dysfunctional and sometimes dystopian.”

The Google policy allowed subscription web sites to be included in searches despite their content being mostly unavailable to non-paying users.