M+E Connections

Verizon Media: Fans are Open to Paying More to Stream Live Sports

Story Highlights

There is a huge opportunity for content providers streaming live sports if they can provide sports fans with greater personalization, better viewing options and a different advertising experience that is better suited to a streaming environment, according to the findings of a survey commissioned by Verizon Media.

Almost two thirds (63%) of 5,018 sports fans in the U.S., U.K., France, Germany and Holland who were surveyed in December said they would consider paying — or paying more if they already do so — for a live sports streaming service. But there was one caveat: That the service provided them with coverage of a sports league or team that interested them, said Verizon Media, which partnered with Leaders in Sport to release a report, “Viewing Shifts: How we watch sport,” unveiling viewing trends and consumer habits behind the rapid growth of live sports streaming.

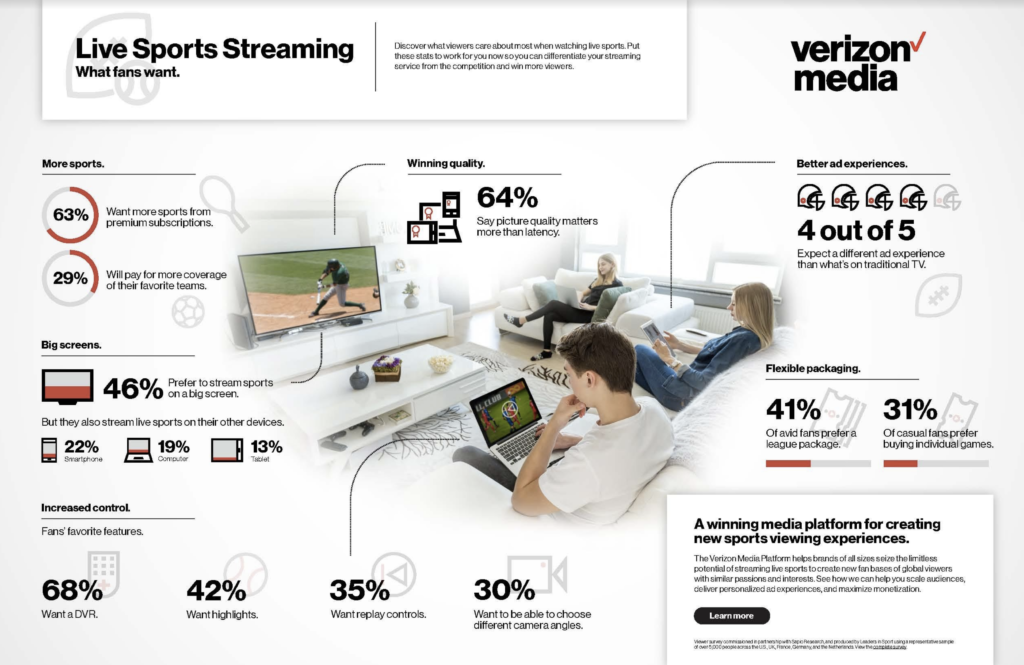

Verizon Media also created an infographic touting some of the key things viewers are saying they want when it comes to live sports streaming. The infographic and report are both part of the company’s current live sports campaign.

Among the other findings of the survey was that only 47% of respondents with a premium subscription said they felt the service gave them access to all the teams they wanted to watch, Verizon Media said, noting that points to a market with a lot of opportunity for growth.

Fifty-one percent of sports fans, meanwhile, specifically use streaming services to follow sports that are not available to them anywhere else, according to the survey. Respondents indicated they liked the flexibility and high-quality experience streaming provided them.

Thirty-nine percent used a streaming service because it allowed them to watch on their smartphones, while 32% opted to stream live sports in 4K Ultra High Definition. Meanwhile, 37% of respondents said they opted to stream live sports over-the-top because they saw that as a less expensive alternative to satellite or cable pay TV. However, 46% said they preferred to stream sports on a big screen, compared to only 22% on smartphones, 19% on computers and 13% on tablets.

The key takeaway is that “there is a huge opportunity for content providers to reshape the entire landscape of live sports by offering more choice and deeper coverage of specific teams,” according to Ariff Sidi, general manager, Media Platform at Verizon Media. “There is the potential to build global audiences around niche sports and leagues that don’t currently get enough airtime, but to do so they must employ the latest and most flexible technology resources,” he said.

Live sports streaming service providers need to be aware, however, that sports fans will cancel if they don’t see enough value in the service they are subscribing to.

Live sports streaming service providers need to be aware, however, that sports fans will cancel if they don’t see enough value in the service they are subscribing to.

Over a third (37%) of sports fans surveyed said they cancelled a live streaming subscription, with 45% citing cost as the main reason.

The most passionate sports consumers (those who consume 11-plus hours of live sports content a week) cancel services due to issues that include a lack of coverage of the teams they follow (23%), a hard-to-use interface (15%) or inordinate delay behind live (19%).

About one in three sports fans, meanwhile, are looking for more control over the live experience, and that includes wanting access to replay controls like slow motion (35%), as well as the ability to switch between camera angles, time shifting and the ability to skip ads (30% each).

There is also significant interest in gaining easier access to match highlights (42%) and libraries of on-demand content (22%). A whopping 68% want a DVR.

Although there is a lot of industry talk about streaming services being “TV-like,” Sidi pointed out: “Sports fans actually want a different experience that puts them in total control. Streaming services are much more capable of innovating because they have the luxury of using advanced technology that can serve every consumer need from day one. Live sports streaming services can emulate the best aspects of traditional television while bringing totally unique immersive experiences to fans.”

Asked to choose between 4K or improvements to the gap between true live and pictures appearing on screen, more than 60% of survey respondents said they would choose picture quality over reduced latency, Verizon Media said.

Almost nine in 10 respondents (86%) said they expected streaming services to offer a different ad experience, with 54% expecting fewer ads and 29% wanting more personalized advertising and offers.

Sidi concluded: “We’re seeing yet more evidence for the need to tailor content and business models to suit individual viewers. Service providers can make full use of the true flexibility of online streaming to personalize every aspect of the experience – from the content to the way they monetize it.”