M+E Connections

Apple’s Cloud, Other Services Helped Offset Weaker iPhone Sales in Q1

Story Highlights

Apple reported strong revenue from its cloud and other services in the first quarter (ended Dec. 29) that helped offset weakness in its iPhone business.

Services revenue “set an all-time record” of $10.9 billion, up 19% from Q1 a year ago, according to Apple CEO Tim Cook.

“We not only generated our highest global Services revenue ever, but we also had all-time records across multiple categories of Services including the App Store, Apple Pay, cloud services and our App Store search ad business and we had a December quarter record for AppleCare,” he told analysts on an earnings call Jan. 29.

Also significant was that, “nearly 16 years after launching the iTunes Store, we generated our highest quarterly music revenue ever thanks to the great popularity of Apple Music, now with over 50 million paid subscribers,” he said.

Not surprisingly, Apple reported that iPhone revenue declined 15% from a year ago. Cook had already warned in a letter to investors in early January that the company was lowering its Q1 revenue forecast due to factors that included lower-than-expected iPhone sales and weaker-than-expected performance in China overall.

However, Apple said Jan. 29 that total revenue from all other products and services grew 19% in Q1. Revenue from Mac and Wearables, as well as Home and Accessories, also “reached all-time highs,” growing 9% and 33% each, respectively, while iPad revenue grew 17%, Apple said in its earnings news release.

Despite the weaknesses seen in Q1, Apple’s “total active installed base of devices has grown from 1.3 billion at the end of January of 2018 to 1.4 billion by the end of December, reaching a new all-time high for each of the main product categories and for all five of our geographic segments,” Cook said on the call, adding: “Not only is our large and growing installed base a powerful testament to the satisfaction and loyalty of our customers, but it’s also fueling our fast-growing Services business.”

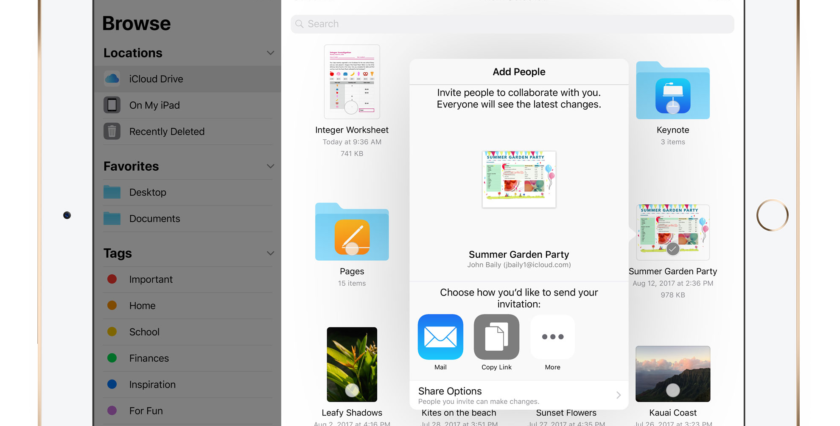

Cloud services revenue “continues to grow rapidly, with year-over-year revenue up” more than 40% in the quarter, Cook said.

Readership of the Apple News app, meanwhile, “set a new record, with over 85 million monthly active users in the three countries where we’ve launched” so far: the U.S., U.K. and Australia, he said. In the U.S., the latest Comscore data showed Apple News had the largest audience of all news apps, he said, predicting the international audience “will continue to grow with our first-ever bilingual launch in Canada available to customers later this quarter.”

Apple management was “very happy not only with the growth, but also the breadth of our Services portfolio,” Cook said, pointing out Services revenue grew from under $8 billion in 2010 to over $41 billion in 2018. “The largest category represents less than 30% of total Services revenue and the new services we’ve launched in the last few years are all experiencing tremendous growth,” he said.

Despite the disappointing iPhone sales in Q1, Apple CFO Luca Maestri told analysts the global active installed base of iPhones “continues to grow and has reached an all-time high at the end of December,” surpassing 900 million devices, “up year-over-year in each of our five geographic segments and growing almost 75 million in the last 12 months alone.”

Apple is also “just beginning to see the impact we can make to improving health and are deeply inspired by the possibilities,” Cook said, pointing as an example to the work the company is doing with silicon. He noted: “We’ve embedded machine learning directly into the silicon with our A12 Bionic chip. Our custom neural engine not only provides power efficiency and incredible performance in a very small package, but it also enables processing of data and transactions directly on the device. This means iPhone can recognize patterns make predictions and learn from experience and it does all this while keeping personal information private. This is a powerful example of how innovation and privacy can go hand-in-hand at a time when these issues are increasingly important to our users.”

Total Apple Q1 revenue declined 5% to $84.3 billion, while net profit dipped to $20 billion from $20.1 billion. But earnings per diluted share increased to $4.18 from $3.89. International sales represented 62% of Q1 revenue, Apple said.