Connections

The Quorum Provides a Data-Driven Way to Gauge the Post-Pandemic Film Business

Story Highlights

Traditional methods to gauge how well a movie will perform no longer apply today amid the rise of streaming services and the arrival of the COVID-19 pandemic, but the data-driven approach taken by The Quorum can answer that and other pressing questions faced by the film industry post-pandemic, according to David Herrin, its CEO and founder.

“I realized a couple of years ago that film tracking was really not quite working,” he said during the Consumers & Analytics breakout session “A Data-Driven Look at the Post-Pandemic Movie Business” at the March 16 Smart Content Summit.

Before starting The Quorum in September, Herrin was with United Talent Agency (UTA) as its head of research for 19 years, where he was able to focus on his “passion, which is predictive analytics” in the film industry, forecasting how a movie would do before it was released, he said. At UTA, he did it in the interest of the company’s clients, who were actors, writers and other members of the film industry.

“Film tracking has been around for decades,” Herrin noted, pointing out “there are a handful of players in the space” and what they do is poll people about upcoming movie releases. Studios use that data to measure the health of a film’s marketing campaign.

Historically, film tracking has focused on awareness of an upcoming movie and consumer interest in seeing it or not.

Historically, film tracking has focused on awareness of an upcoming movie and consumer interest in seeing it or not.

“That has really served the movie industry for decades now,” Herrin said. “But there are a lot of market forces that are happening that are rendering that way of thinking about film tracking as obsolete,” he told viewers.

An “Inflection Point”

Oct. 16, 2015 was an “inflection point,” Herrin said, noting that’s when Netflix released Beasts of No Nation, its first original feature film, and “then the cat was out of the bag” and the business has never been the same.

“The biggest change that we’ve seen over the past five or six years is the emergence of Netflix,” he said.

One effect of the growing strength of Netflix is that certain genres are not performing theatrically as well as they used to, he noted. “The biggest ones are comedies and young adults,” which are no longer generating nearly as much interest as the box office as they used to, he said. And the reason why is that “Netflix is making very high-quality, theatrical-quality comedy and YA movies that are part of your Netflix subscription and [when it’s] part of your Netflix subscription it feels like it’s free,” he pointed out.

Big-budget Marvel and DC movies, meanwhile, have become dominant at the box office.

“Ultimately what it comes down to is this idea of a value proposition,”

according to Herrin. “Am I going to spend $8 to $15 to go see a movie in a theater and is the movie worth it for me to spend that money? And for comedies and YA, given the fact that those are available on Netflix, the proposition is probably no. But for Marvel and DC movies, the value proposition is still there.”

The Future

Box office admissions were “tapering off” starting in 2019 and declining among some demographics, Herrin said.

Then the pandemic hit. “What we suspect is going to happen is that some of those downward trends and those behavioral market forces that we saw pre-pandemic have likely been accelerated by behavioral shifts created by this pandemic,” especially the shift to watching movies at home via streaming services and premium video on demand, according to Herrin.

“Tracking going forward has to capture these shifts and that’s what The Quorum is all about,” he explained.

“About a decade ago, there was this shift in film tracking towards using social data and I was a big proponent of that,” he conceded. “The truth is that for some time it has worked. But social has a lot of problems,” which include: “Volume is very easy to manipulate; sentiment is still questionable” (although some will disagree); “there are no reliable ways to measure video content”; and “metrics can be bought.”

Therefore, “I really believe that in this particular [time, with] film tracking, we are in a post social data environment,” and “the pendulum” that swung in favor of social has “now swung back to panel,” he explained.

Three Focus Areas

Three Focus Areas

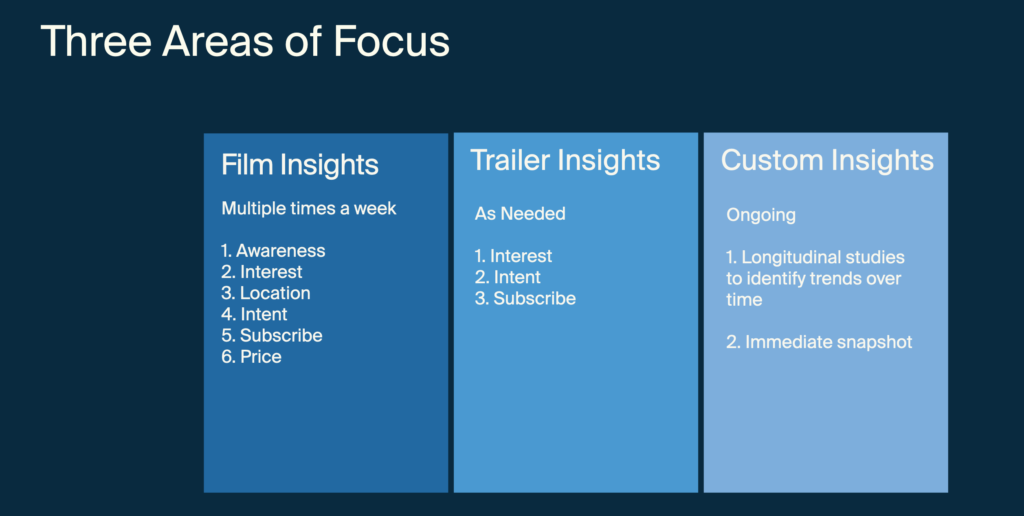

“The Quorum is focused on three areas:” Film insights, trailer insights and custom insights, Herrin said.

For film insights, The Quorum polls people about their interest in seeing upcoming movies multiple times a week and capturing “nuance is really important” when talking about consumer interest in a movie, he explained.

Unlike in years past, today there are also several locations where people may be interested in seeing a movie, so The Quorum polls consumers on where they expect to watch a film also, as well as whether somebody will subscribe to a service just to watch a movie on it and what price they will be willing to pay, if any, he said.

With trailer insights, The Quorum asks the same kinds of questions on movies whenever a new trailer is released, while custom insights is where the company focuses on “fun stuff” such as specific topics, he explained.

One key factor is what groups films belong to, he said, noting that is more significant than what genre they’re in. For example, John Wick and Nobody are the same genre but belong in different groups because one is part of a successful franchise and the other is not.

The Quorum divides films up into six basic groups: Marvel/DC; tentpoles outside the Marvel and DC universes; sequels at much lower budgets that are not expected to perform at the same level as tentpoles and Marvel/DC movies; animation; known IP; and originals.

Originals are “where Netflix has had the greatest success” and to a lesser degree other streaming services also, Herrin said.

“When theaters come back, it will be interesting to see if any films” in the originals group and “even the known IP can succeed theatrically,” he went on to say.

The Quorum released its first newsletter in January, which includes data points on movies and the website Quorum.com will launch in April, he told viewers. It will be available for the general public instead of “behind a walled garden” like other data services “so all of the data that the studios were using for themselves is now going to be available for everybody to see,” he added.

Click hereto access video of the presentation.

Click here to download the presentation.

The Smart Content Summit was produced by MESA and the Smart Content Council, and was sponsored by Microsoft Azure, Whip Media Group, Richey May Technology Solutions, BeBanjo, Digital Nirvana, Softtek, 24Notion, EIDR, The Quorum and Signiant.